Market Overview

Global crypto market cap has dropped below $4.0 trillion, currently around $3.9-4.0T. CoinCentral+3CoinGecko+3Coinspeaker+3

Market is in a correction phase: sharp liquidations (≈ $1.5B in bullish bets wiped out) and decline in altcoins. CoinCentral+3The Economic Times+3CryptoPotato+3

Top 10 Crypto Performers

Bitcoin (BTC): ~$113,000 – down ~2.5% on the week, rejected at $117K resistance

Ethereum (ETH): ~$4,180 – down ~6% on the week, heavy liquidations weighing

Binance Coin (BNB): ~$1,025 (-1.4%)

Solana (SOL): ~$222 (-7.1%)

XRP: ~$2.92 (-3.5%)

Cardano (ADA): ~$0.83 (-2.9%)

Polkadot (DOT): ~$9.10 (-3.7%)

Dogecoin (DOGE): ~$0.238 (-4.2%)

Polygon (MATIC): ~$0.88 (-3.8%)

Litecoin (LTC): ~$103 (-2.6%)

Investor Sentiment & Market Dynamics

Fear & Greed Index is neutral / weak (~45-50ish) rather than in “greed” territory. Coinpedia Fintech News+2CoinCentral+2

Bitcoin dominance rising as altcoins weaken. Coinpedia Fintech News+2CoinCentral+2

Liquidations large, especially for ETH and smaller tokens, which amplify downside. CryptoPotato+1

This Week in Crypto

Crypto slump following Fed’s rate move

Bitcoin, Ethereum, XRP and other majors dropped after the Federal Reserve’s interest-rate cut, with excessive leverage blamed for accelerating losses through liquidations. Barron'sUK-US regulatory cooperation intensifies

The UK and the US are moving toward closer cooperation on crypto regulation and stablecoin frameworks. Goal: align regulatory systems, allow UK firms more access to US capital markets. Financial TimesBitcoin Strategic Reserve Act discussions in US Congress

Industry leaders and lawmakers met to push legislation to establish a federal bitcoin reserve (targeting up to 1 million BTC over 5 years) via seized assets, Fed earnings, etc. InvestorsCorporate treasuries increasing crypto exposure

Some firms raising capital or using corporate balance sheets to hold digital assets. Example: Helius Medical Technologies raising over $500M to invest in Solana; strategy stock investments tied to Bitcoin accumulation. Barron's“Best cryptos to buy” lists are spotlighting altcoins and meme/Layer-2 projects

Analysts and media highlight XRP, Cardano, Solana, DOGE and newer entrants (e.g. Little Pepe, Layer Brett) as strong picks for Q4 based on technicals, fundamentals and community interest. Indiatimes+2Indiatimes+2Liquidations and market fragility

Over $1-1.7B in leveraged positions were liquidated as downside in major coins triggered cascade effects. CryptoNews+2Barron's+2Declining investor sentiment & technical resistances

Rejection near resistance levels (esp. BTC near ~$117K), technical indicators turning bearish for some coins such as XRP; broad market retracement. Barron's+2CoinDesk+2Presale and meme coin hype rises

Little Pepe’s ongoing presale, Layer Brett, and other meme or community-driven tokens are gaining traction. Some presales report strong fundraising and high “stake-yield” or reward incentives. Indiatimes+2Indiatimes+2Institutional rotation & ETFs

ETH ETFs continue to draw interest even as BTC faces resistance; analysts note rotation between yield-bearing and growth-oriented assets within crypto. Barron's+1Growing policy risk / regulatory clarity in flux

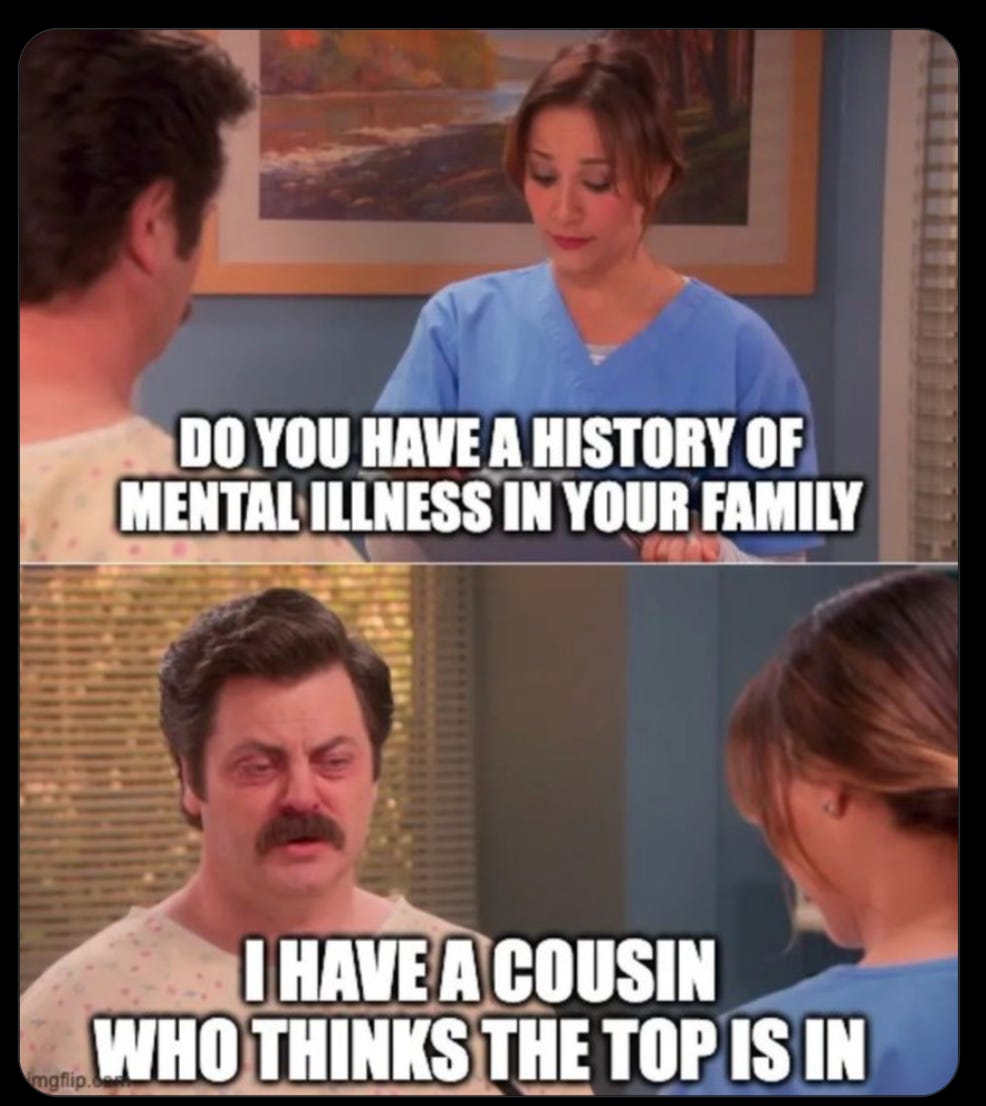

While there are cooperation efforts (UK/US), regulatory uncertainty remains a risk. Some policy initiatives are promising (e.g. strategic reserves, sandbox frameworks), but legislation/regulation is not yet settled. Financial Times+1Meme of the Week