Market Overview

The global crypto market cap is hovering around $3.9–4.0 trillion, recently reported at ~ $3.96 trillion. CoinGecko

The market remains in a correction / consolidation phase. Significant liquidations (exceeding $1.5 billion) have occurred, particularly in leveraged long positions. The Economic Times+3Business Insider+3Barron’s+3

Volatility is elevated, and altcoins are under pressure, with many failing to hold support zones.

Top Cryptocurrencies Performance

Bitcoin (BTC): ~$112,100 - Down ~2.8% over 7 days

Ethereum (ETH): ~$4,120 - Down ~6–10%, heavy liquidation pressure

Binance Coin (BNB): ~$1,020 - Relatively flat to modest down moves

Solana (SOL): ~$220 - Suffering deeper downside, likely > –7%

XRP: ~$2.88 - Down ~3–5%

Cardano (ADA): ~$0.85 - Down ~2–5%

Polkadot (DOT): ~$4.50 - Understeep pressure

Dogecoin (DOGE): ~$0.24 - Modest declines (–3 to –7%)

Polygon (MATIC): ~$0.88 - Likely also under pressure; not always in top-10 by market cap lists

Litecoin (LTC): ~$103

Investor Sentiment & Market Dynamics

The Fear & Greed Index remains weak to neutral (in the 40s–50s range), indicating cautious or mixed sentiment.

Bitcoin dominance is creeping upward as altcoins underperform and capital rotates toward the more “stable” large-caps.

Liquidations continue to be a key driver of volatility, especially in mid-caps and smaller tokens, amplifying downside moves. Barron’s+2Business Insider+2

Technicals across many altcoins are deteriorating: multiple names have broken down through support zones, and resistances are holding firm.

This Week in Crypto

Massive Selloff & Liquidations

The week saw one of 2025’s most severe deleveraging events, with estimates of $1.5–$1.7 billion in liquidations across major tokens. The Economic Times+4Barron’s+4Business Insider+4

The crash wiped out a big chunk of recent gains and forced many leveraged players to exit. The Economic Times+2FinancialContent+2“Red September” Takes Its Toll

September is turning into a red month for many cryptos, with broad losses erasing earlier gains. Some reports estimate $300 billion+ in value wiped out over the month. Decrypt+3FinancialContent+3The Economic Times+3Regulatory & Policy Developments

The UK and US are seeking closer alignment in crypto and stablecoin regulation to reduce fragmentation and improve cross-market access. Financial Times

Continued debate in the US over the Strategic Bitcoin Reserve / digital asset stockpile proposals. Wikipedia+1

Tether (USDT) is reportedly eyeing a valuation near $500 billion in an upcoming private raise, highlighting how critical stablecoins remain in the ecosystem. Reuters+1

Institutional / Whale Moves

Whale accumulation has been noted for both BTC and ETH, signaling that some large players view the correction as an opportunity. The Economic Times

Some firms are also quietly increasing exposure in crypto via allocations or holding via treasuries (though these remain more sidelined stories in this environment).Meme / Presale Hype Continues

Projects like Little Pepe (LILPEPE) and AlphaPepe (ALPE) are generating buzz. These presales / meme-zone tokens are seeing fundraising and speculative interest despite the broader market pullback. Indiatimes+1Rotation & ETF / Yield Play Dynamics

Despite BTC having resistance overhead, ETH ETFs and yield-bearing structures remain a key battleground. Rotation between yield & growth (staking, DeFi) vs pure price plays is more active.

Some asset managers are rebalancing, reducing overexposure to the more volatile names, and increasing allocations to stablecoins or safer cryptos. AInvest+1Fragility & Market Structure Risk

The correction has exposed structural vulnerabilities — liquidity gaps, weak support zones in many alt names, high leverage. Further downside is possible, especially if macro data disappoints or regulatory overhangs intensify.

Outlook & Key Themes to Watch

Support & Resistance Zones

BTC’s ability to hold around $110,000–$113,000 is critical. A breakdown may drag many alts further down.

For ETH and altcoins, failure to reclaim broken supports could push them into further corrective territory.Liquidity & Macro Backdrop

Broader macro forces (rate cuts, inflation data, global growth) will likely play outsized roles. A dovish tilt from central banks or renewed liquidity injection could offer relief.Regulation as a Catalyst / Risk

If UK/US regulatory cooperation produces clarity (especially around stablecoins, securities law, and custodial frameworks), it may help reduce risk premia. But regulatory overreach or sudden policy turns can spook markets.Accumulation by Smart Money

Watching on-chain signals, whale flows, and institutional buying will help catch early signs of market stabilisation.Selective Opportunity in Alts & Presales

While many alts are under pressure, oversold names or emerging presales might offer high-risk / high-reward setups. But risk is elevated, so capital allocation must be cautious.Forced Liquidations as a Tail-Risk

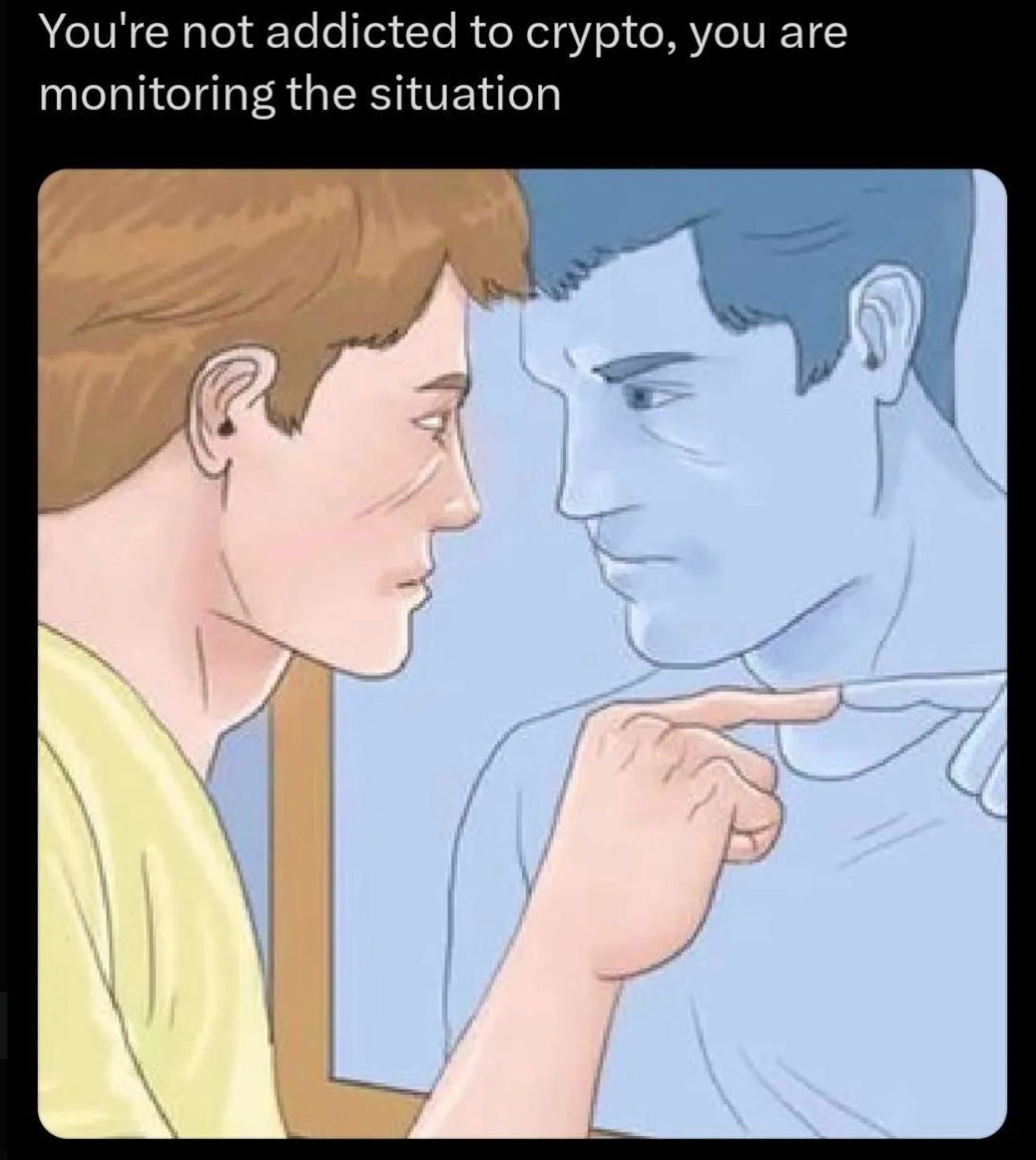

Even modest triggers can cascade via liquidation cascades, especially in illiquid or thinly traded names. Risk management is paramount now.Meme of the Week